2007 Hybrid Car Registrations Hit New High

R. L. Polk & Co. are reporting a 38% increase in hybrid car registration for 2007 for a total of 350,289. In 2006, they reported 254,54...

https://iskablogs.blogspot.com/2008/04/2007-hybrid-car-registrations-hit-new.html

R. L. Polk & Co. are reporting a 38% increase in hybrid car registration for 2007 for a total of 350,289. In 2006, they reported 254,545 new hybrid car registrations across the US, which was a 28 percent increase from 2005.

R. L. Polk & Co. are reporting a 38% increase in hybrid car registration for 2007 for a total of 350,289. In 2006, they reported 254,545 new hybrid car registrations across the US, which was a 28 percent increase from 2005.California remains the clear leader in total numbers, while the other states moved around slightly in the rankings. The same top 10 states still account for over 61% of the hybrid car registrations. Oklahoma once again showed the biggest gain (148%) from 2006, but that is more indicative of the small numbers being sold.

| 2006 Rank | State | Total New Hybrid Registrations, 2006 CY | Share of US Hybrid Volume, 2006 CY (%) | Total New Hybrid Registrations, 2007 CY | Share of US Hybrid Volume, 2007 CY (%) | ||||

| 1 | California | 67,533 | 26.5% | 91,417 | 26.1% | ||||

| 2 | Florida | 12,900 | 5.1% | 19,283 | 5.5% | ||||

| 3 | Texas | 12,550 | 4.9% | 17,196 | 4.9% | ||||

| 4 | New York | 11,634 | 4.6% | 17,385 | 5.0% | ||||

| 5 | Virginia | 10,424 | 4.1% | 11,952 | 3.4% | ||||

| 6 | Illinois | 9,495 | 3.7% | 13,094 | 3.7% | ||||

| 7 | Washington | 8,650 | 3.4% | 13,107 | 3.7% | ||||

| 8 | Pennsylvania | 8,407 | 3.3% | 11,089 | 3.2% | ||||

| 9 | Massachusetts | 7,365 | 2.9% | 9,982 | 2.8% | ||||

| 10 | New Jersey | 7,021 | 2.8% | 9,645 | 2.8% |

SOUTHFIELD, Mich., April 21 /PRNewswire/ -- Nationwide registrations

for new hybrid vehicles rose to 350,289 registrations in 2007 - a 38

percent increase from 2006, according to R. L. Polk & Co. The Toyota Prius

continued to lead the segment with 179,178 total new registrations - 51.2

percent of hybrid market share.

"Auto buyers are benefiting from new hybrid launches, and fleecing of

old models that didn't work. There is a lot of excitement being generated

within the industry as manufacturers adjust plans to adapt to consumer

demand," said Lonnie Miller, director of Industry Analysis at Polk. "While

the Toyota Prius has a stronghold on the midsize car hybrid segment, the

Toyota Highlander and Ford Escape share leadership positions in the SUV

hybrid segment. As hybrid buyers migrate within a brand, manufacturers have

to be prepared to meet their expectations for offerings if they want

consumers to remain loyal."

While most of the market continues to see hybrid models enabled by

various forms of gas-electric powertrains, the entire hybrid segment will

evolve as other technologies are developed and tested. With the end-goal of

providing more fuel-efficient vehicles, future offerings will expand beyond

the current generation of hybrid models.

"Hybrids are a great foray into the world of fuel-efficiency for many

buyers," said Miller. "Unfortunately, we still have an uphill battle for

diesel and ethanol adoption given the need for more consumer education and

improvements with filling station infrastructure. It will be interesting to

see how more advanced technologies progress this whole category, but they

can't come soon enough."

Segment Affinity

Polk's analysis shows that buyers of specific hybrid models

predominantly come from the vehicle segment shared by their new hybrid

purchase. In 2007, 55 percent of new hybrid buyers previously had a midsize

car, midsize SUV or small car model. These vehicle segments represent the

majority of the volume in the hybrid category and indicate consumers may be

predisposed to a body style first before choosing a hybrid model.

"In cases such as the Lexus LS600h, more than half of these buyers came

from the prestige luxury segment," said Miller. "In the case of Honda Civic

hybrid buyers, nearly 30 percent already had a small car in their driveway.

There's a strong relationship between the vehicle previously owned and the

segment they may buy when selecting a hybrid."

For manufacturers' marketing departments, these findings mean they may

be able to repurpose some of the brand research and customer studies for

non-hybrid models when creating new hybrid offerings or hybrid marketing

campaigns. In addition, more luxury hybrids are available than ever before,

allowing customers to obtain a hybrid without sacrificing features,

amenities and performance they might otherwise be used to.

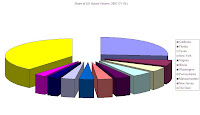

Regional Dominance

Geographic trends for the segment remain largely unchanged in 2007,

with California continuing to hold 26 percent of hybrid market share

followed by Florida, New York, Texas and Washington (Table 1). For the

second year in a row, Oklahoma had the greatest increase, up nearly 148

percent. Similarly, Los Angeles and San Francisco led cities nationwide

combined with more than 19 percent of the segment's market share (Table 2).

"The coasts continue to dominate the hybrid segment, though we continue

to see gains in the Midwest as fuel prices hit home for the 'manufacturing

belt' states," said Miller.

About R. L. Polk & Co.

R. L. Polk & Co. is the premier provider of automotive information and

marketing solutions. Polk collects and interprets global data, and provides

extensive automotive business expertise to help customers understand their

market position, identify trends, build brand loyalty, conquest new

business and gain a competitive advantage. Polk helps automotive

manufacturers and dealers, automotive aftermarket companies, finance and

insurance companies, advertising agencies, media companies, consulting

organizations, government agencies and market research firms make good

business decisions. A privately held global firm, Polk is based in

Southfield, Mich. with operations in Australia, Canada, China, France,

Germany, Japan, Spain, the United Kingdom and the United States. For more

information, please visit http://www.polk.com.

Table 1 - Top 10 Hybrid States (2007 Calendar Year)

Rank State Total New Share of U.S. Volume Increase

Hybrid Hybrid from

Registrations Volume 2006 CY (%)

2007 CY 2007 CY (%)

1 California 91,417 26.1 35.4

2 Florida 19,283 5.5 49.5

3 New York 17,385 5.0 49.4

4 Texas 17,196 4.9 37.0

5 Washington 13,107 3.7 51.5

6 Illinois 13,094 3.7 37.9

7 Virginia 11,952 3.4 14.6

8 Pennsylvania 11,089 3.2 31.9

9 Massachusetts 9,982 2.8 35.5

10 New Jersey 9,645 2.8 36.1

Source: R. L. Polk & Co. U.S. New Hybrid Registrations, 2007 Calendar

Year.

Table 2 - Top 10 Hybrid Metro Markets (2007 Calendar Year)

Rank Market (DMA(R)) Total New Share of U.S. Volume Increase

Hybrid Hybrid from

Registrations Volume 2006 CY (%)

2007 CY 2007 CY (%)

1 Los Angeles 40,634 11.6 31.1

2 San Francisco 27,292 7.8 32.3

3 New York 20,692 5.9 45.2

4 Washington D.C. 12,744 3.6 12.2

5 Seattle 11,098 3.2 53.2

6 Chicago 10,611 3.0 39.2

7 Boston 10,438 2.8 33.9

8 Philadelphia 8,670 2.5 26.4

9 Sacramento 7,871 2.2 59.9

10 Phoenix 7,829 2.2 85.4

Source: R. L. Polk & Co. U.S. New Hybrid Registrations, 2007 Calendar

Year.